CORMEDIX INC. REPORTS SECOND QUARTER AND SIX MONTH 2023 FINANCIAL RESULTS AND PROVIDES BUSINESS UPDATE

Conference Call Scheduled for Today at 8:30 a.m. Eastern Time

Berkeley Heights, NJ – August 8, 2023 – CorMedix Inc. (Nasdaq: CRMD), a biopharmaceutical company focused on developing and commercializing therapeutic products for the prevention and treatment of life-threatening diseases and conditions, today announced financial results for the second quarter and six months ended June 30, 2023 and provided an update on recent business events.

Recent Corporate Highlights:

- CorMedix’s DefenCath NDA was accepted for filing by the U.S. Food and Drug Administration (FDA) and was assigned a Prescription Drug User Fee Act (PDUFA) target action date of November 15, 2023.

- CorMedix announced a first-of-kind strategic initiative with Boston Medical Center to enhance patient safety and reduce health disparities in structurally marginalized populations at risk for catheter-related bloodstream infections (CRBSIs) while undergoing dialysis. In the initial stages of the strategic alliance, the parties will assess the incidence and scope of CRBSIs, CRBSI-related readmissions, and other information.

- Center for Medicare and Medicaid Services has finalized its Inpatient Prospective Payment System 2024 rule that included a New Technology Add-On Payment (NTAP) of up to $17,111 per hospital stay for reimbursement of DefenCath if approved by FDA.

- CorMedix completed an equity offering in July 2023 which generated net proceeds of approximately $43.2 million. This includes a full exercise of the over-allotment option which yielded gross proceeds of approximately $6.0 million.

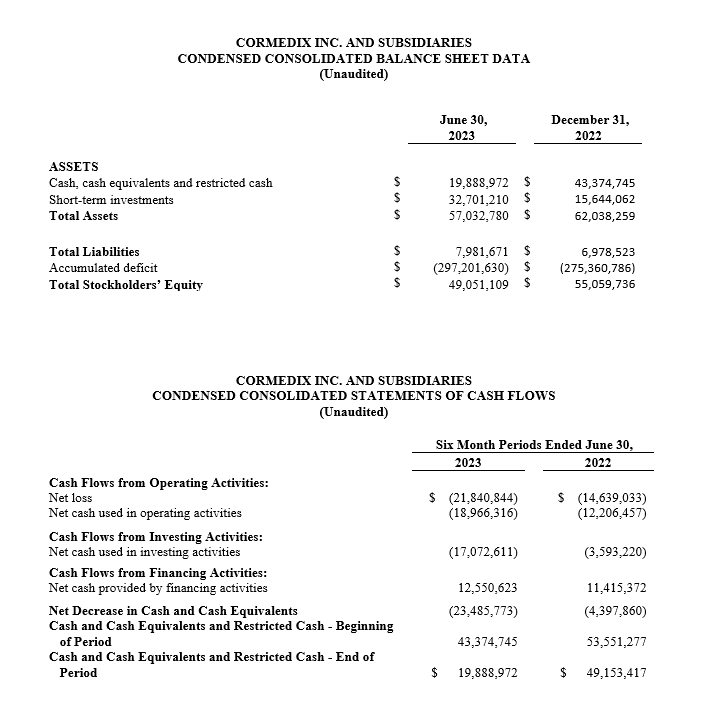

- Cash and short-term investments, excluding restricted cash, at June 30, 2023 amounted to $52.4 million, and including net proceeds from the equity offering that closed in July 2023, pro forma cash and short-term investments of approximately $95 million.

Joe Todisco, CorMedix CEO, commented, “we are pleased with the progress that we have made toward our goal of achieving a potential FDA approval of DefenCath later this year. With the recent financing completed, we believe CorMedix is in a strong financial position and we are heavily focused on operational execution and commercial preparedness ahead of our target action date in November. We look forward to providing updates as we aim to deliver on our commitment to reducing the risk of infections in patients receiving hemodialysis via central venous catheters.”

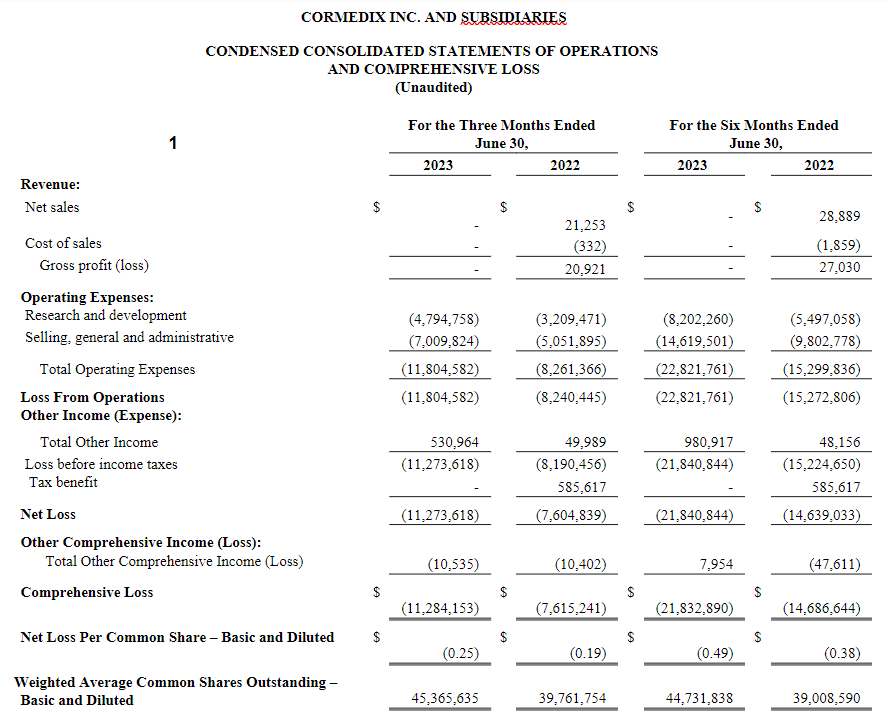

Second Quarter and Six Month 2023 Financial Highlights

For the second quarter of 2023, CorMedix recorded a net loss of $11.3 million, or $0.25 per share, compared with a net loss of $7.6 million, or $0.19 per share, in the second quarter of 2022, an increase of $3.7 million or 48%. The higher net loss recognized in 2023 compared with 2022 included an increase in both SG&A expenses and R&D expenses versus the second quarter of 2022.

Operating expenses in the second quarter of 2023 increased approximately 43% to $11.8 million, compared with $8.3 million in the second quarter of 2022. R&D expense increased approximately 49% to $4.8 million compared with $3.2 million in the second quarter of 2022, mainly due to an increase in costs related to the manufacturing of DefenCath prior to its potential marketing approval. SG&A expense increased approximately 39% to $7.0 million compared with $5.1 million in the second quarter of 2022. This increase was driven primarily by an increase in costs related to market research studies and pre-launch activities in preparation for the potential marketing approval of DefenCath.

For the six months ended June 30, 2023, CorMedix recorded a net loss of $21.8 million, or $0.49 per share, compared with a net loss of $14.6 million, or $0.38 per share, in the first half of 2022. Operating expenses in the first half of 2023 were $22.8 million, compared to $15.3 million in the first half of 2022, an increase of approximately 49%. This increase was primarily due to costs related to market research studies, pre-launch activities in preparation for the potential marketing approval of DefenCath and costs for the manufacturing of DefenCath prior to its potential marketing approval.

The Company reported cash and short-term investments of $52.4 million at June 30, 2023, excluding restricted cash. In addition, CorMedix received approximately $43.2 million in net proceeds from its equity financing that closed in July of 2023. The Company believes that it has sufficient resources to fund operations for at least twelve months from the filing of its Quarterly Report on Form 10-Q for the quarter ended June 30, 2023.

Conference Call Information

The management team of CorMedix will host a conference call and webcast today, August 8, 2023, at 8:30 AM Eastern Time, to discuss recent corporate developments and financial results. Call details and dial-in information are as follows:

Tuesday August 8th @ 8:30am ET

Domestic: 1-877-423-9813

International: 1-201-689-8573

Conference ID: 13740152

Webcast: Webcast Link

About CorMedix

CorMedix Inc. is a biopharmaceutical company focused on developing and commercializing therapeutic products for the prevention and treatment of life-threatening conditions and diseases. The Company is focused on developing its lead product DefenCath™, a novel, non-antibiotic antimicrobial solution designed to prevent costly and life-threatening bloodstream infections associated with the use of central venous catheters in patients undergoing chronic hemodialysis. DefenCath has been designated by FDA as Fast Track and as a Qualified Infectious Disease Product (QIDP), and the original New Drug Application (NDA) received priority review in recognition of its potential to address an unmet medical need. QIDP provides for an additional five years of marketing exclusivity, which will be added to the five years granted to a New Chemical Entity upon approval of the NDA. CorMedix also committed to conducting a clinical study in pediatric patients using a central venous catheter for hemodialysis when the NDA is approved, which will add an additional six months of marketing exclusivity when the study is completed. CorMedix received a second Complete Response Letter from the FDA last August related to deficiencies at both its primary contract manufacturer and its supplier of heparin API. After receiving guidance from FDA at a Type A meeting in April of 2023, the NDA for DefenCath was resubmitted. In June of 2023, the resubmitted NDA was accepted for filing by the FDA. CorMedix also intends to develop DefenCath as a catheter lock solution for use in other patient populations, and the Company is working with top-tier researchers to develop taurolidine-based therapies for rare pediatric cancers. For more information visit: www.cormedix.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. All statements, other than statements of historical facts, regarding management’s expectations, beliefs, goals, plans or CorMedix’s prospects, including, but not limited to, CorMedix’s future financial position, financing plans, future revenues, projected costs and the sufficiency of our cash and short-term investments to fund our operations should be considered forward-looking statements. Readers are cautioned that actual results may differ materially from projections or estimates due to a variety of important factors, including: the risks and uncertainties related to market conditions; the ability to secure final FDA approval prior to July 1, 2024; CorMedix’s ability to manage its cash resources and the impact on current, planned or future research; the ability to achieve commercial preparedness ahead of the target action date in November 2023; and that preclinical results are not indicative of success in clinical trials and might not be replicated in any subsequent studies or trials. These and other risks are described in greater detail in CorMedix’s filings with the SEC, copies of which are available free of charge at the SEC’s website at www.sec.gov or upon request from CorMedix. CorMedix may not actually achieve the goals or plans described in its forward-looking statements, and investors should not place undue reliance on these statements. CorMedix assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Investor Contact:

Dan Ferry

Managing Director

LifeSci Advisors

(617) 430-7576