CORMEDIX INC. REPORTS THIRD QUARTER 2019 FINANCIAL RESULTS AND PROVIDES BUSINESS UPDATE

Conference Call Scheduled for Today at 4:30 p.m. Eastern Time

Berkeley Heights, NJ – November 14, 2019 – CorMedix Inc. (NYSE American: CRMD), a

biopharmaceutical company focused on developing and commercializing therapeutic products

for the prevention and treatment of infectious and inflammatory disease, today announced

financial results for the third quarter and nine months ended September 30, 2019 and provided

an update on recent business developments.

Recent Corporate Highlights:

- Positive responses received from the FDA regarding the Company’s pre-New Drug

Application, or pre-NDA, meeting questions relating to the preparation of the NDA. The

FDA agreed that Neutrolin is eligible for priority review, setting a review period goal of 6

months rather than the standard review period of 10 months. The FDA also agreed that

the Neutrolin NDA submission is eligible for rolling review and that the Company’s

proposed submission plan is reasonable. The FDA further agreed that it is appropriate to

submit a request for approval of Neutrolin under the Limited Population Pathway for

Antibacterial and Antifungal Drugs (LPAD Pathway) at the time of the NDA submission. - The Company completed its interaction with the FDA related to the chemistry,

manufacturing and controls (CMC) package that will be required to support Neutrolin’s

NDA. The FDA was supportive of Neutrolin’s proposed manufacturing program, including

the manufacture of the active pharmaceutical ingredients (APIs), the container closure

and testing, and indicated that it will conduct a thorough review of all of the CMC

information as well as assess the commercial readiness of the various manufacturing

facilities at the time of the NDA filing. No further CMC meetings with the FDA are planned

prior to the NDA submission. - The Company believes it is on schedule for NDA submission and potential for approval

during the second half of 2020. - CorMedix is developing the regulatory pathways aimed at additional indications for use

in catheters for oncology patients and for patients requiring total parenteral nutrition

(TPN). The Company is first focused on securing the indication for use in hemodialysis

patients utilizing data from LOCK-IT-100, because it believes this strategy will provide

greater opportunity for generating the clinical data needed for additional indications for

use.

Khoso Baluch, CorMedix CEO commented, “We are delighted to have completed the CMC and

pre-NDA meetings with the FDA. I believe we have entered the home stretch towards our goal

of getting Neutrolin approved in the U.S. in the second half of 2020. We are now able to focus

our full attention on submitting the new drug application as quickly as possible. Over the next

several months, we expect to build manufacturing, marketing and medical affairs capabilities in

anticipation of commercial launch either alone or with a partner. This is an exciting time for the

Company and for the staff who have worked so hard to get us where we are today.”

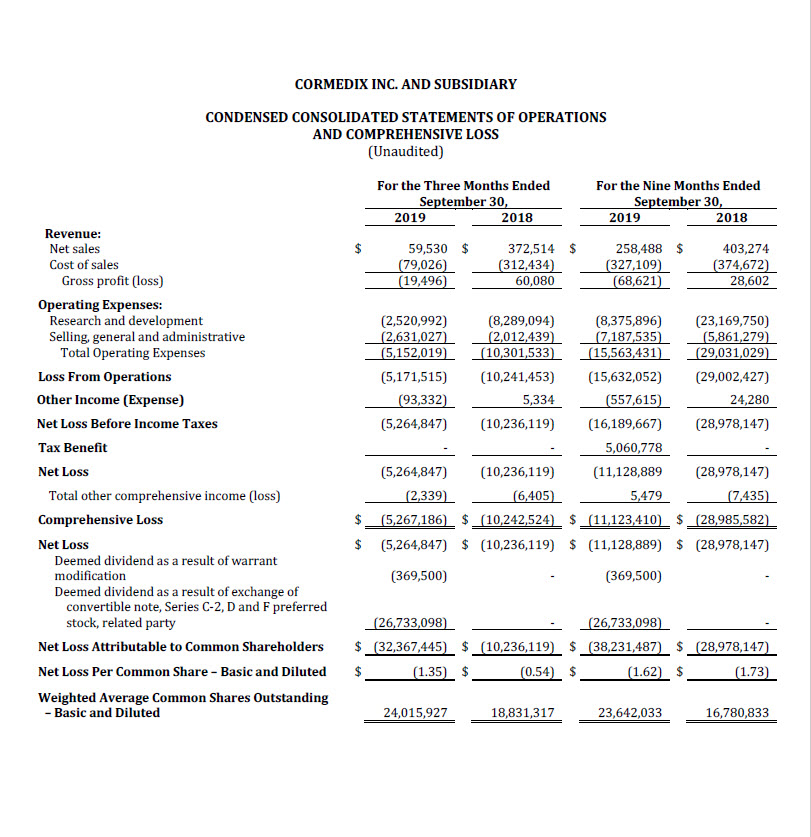

Third Quarter and Nine Month 2019 Financial Highlights

For the third quarter of 2019, CorMedix recorded a net loss attributable to common shareholders

of $32.4 million, or $1.35 per share, compared with a net loss of $10.2 million, or $0.54 per share,

in the third quarter 2018, an increase of $22.2 million. The increase in net loss in the third quarter

2019 compared with the third quarter of 2018 was driven primarily by the deemed dividends

recognized as a result of the exchange agreement and modification of certain warrants

completed in September 2019 totaling $27.1 million. The net loss for the third quarter of 2019

before recognition of the deemed dividends was $5.3 million.

For the nine months ended September 30, 2019, CorMedix recorded a net loss attributable to

common shareholders of $38.2 million, or $1.62 per share, compared with a net loss of $29.0

million, or $1.73 per share, in the first nine months of 2018, an increase of $9.2 million. The

increase in net loss in the first nine months of 2019 compared with the first nine months of 2018

was driven primarily by the deemed dividends recognized as a result of the exchange agreement

and modification of certain warrants totaling $27.1 million during the first nine months of 2019,

partially offset by decreased clinical trial expense of $16.2 million. The net loss before

recognition of the deemed dividends during the first nine months of 2019 was $11.1 million.

Operating expenses during the third quarter of 2019 were $5.2 million, compared with $10.3

million in the third quarter of 2018, a decrease of approximately 50%. This decrease was due

primarily to a $5.8 million, or 70%, decrease in R&D expense, while SG&A expense increased by

31%. Operating expenses during the nine-month period ended September 30, 2019 amounted

to $15.6 million compared with $29.0 million during the comparable period in 2018, a reduction

of $13.4 million, or 46%, due to a 64% reduction in R&D expense partially offset by a 23% increase

in SG&A.

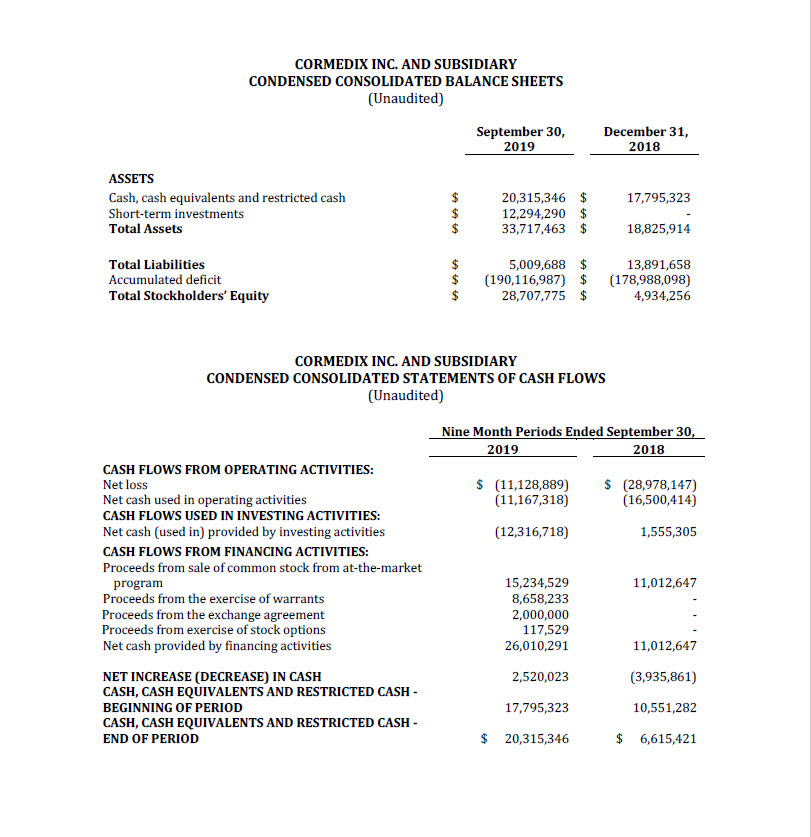

In September 2019, the Company closed an Exchange Agreement with funds managed by Elliott

Management Corporation, its largest investor. In connection with the Exchange Agreement,

Elliott agreed to make a cash payment of $2.0 million and to exchange all of its outstanding

warrants, 10% Senior Secured Convertible Notes (the principal and accrued interest of which

would have amounted to a repayment obligation of approximately $10.1 million or been

convertible into approximately 1.35 million shares if held to maturity), and Series C-2, Series D

and Series F Convertible Preferred Stock for new Series G Convertible Preferred Stock. The new

Series G Convertible Preferred Stock is convertible into an aggregate of 5,560,138 shares of

Common Stock, subject to a claw back of up to 139,769 shares of Common Stock, depending

upon the occurrence of certain stock price-related conditions. With the completion of this

exchange, the Company raised additional capital, became debt-free and substantially reduced

the amount of outstanding warrants as well as its classes of outstanding preferred stock.

Also in September 2019, as part of its continuing efforts to simplify its capital structure, the

Company agreed to reduce the exercise price on 1.2 million of its Series B Warrants expiring

August 2022 from the current exercise price of $5.25 to $4.00 in return for their immediate

exercise, which generated cash of $4.9 million.

The Exchange Agreement and warrant strike price reductions along with exercises of warrants

held by other investors during the 2nd quarter of 2019 resulted in the Company receiving gross

proceeds of approximately $10 million during the quarter and reducing its warrant overhang by

approximately 2.9 million shares. Warrants to purchase approximately 345,000 shares are

currently outstanding.

Total cash on hand and short-term investments as of September 30, 2019 amounted to $32.4

million, excluding restricted cash of $0.2 million. The Company believes that, based on the

Company’s cash resources at September 30, 2019, it has sufficient resources to fund operations

into 2021, including the submission of the NDA for Neutrolin and initial preparations for

commercial launch.

Conference Call Information

The management team of CorMedix will host a conference call and webcast today, November

14, 2019, at 4:30 PM Eastern Time, to discuss recent corporate developments and financial

results. Call details and dial-in information is as follows:

Domestic: 877-423-9813

International: 201-689-8573

Passcode: 13695966

Webcast: http://public.viavid.com/index.php?id=13674

About CorMedix

CorMedix Inc. is a biopharmaceutical company focused on developing and commercializing

therapeutic products for the prevention and treatment of infectious and inflammatory diseases.

The Company is focused on developing its lead product Neutrolin®, a novel, non-antibiotic

antimicrobial solution designed to prevent costly and dangerous bloodstream infections

associated with the use of central venous catheters, currently in Phase 3 development for

patients undergoing chronic hemodialysis. Such infections have significant treatment costs and

lead to increased morbidity and mortality. Neutrolin has FDA Fast Track status and is designated

as a Qualified Infectious Disease Product, which provide the potential for priority review of a

marketing application by FDA and allow for a total of ten years of market exclusivity in the event

of U.S. approval. Neutrolin is already marketed as a CE Marked product in Europe and other

territories. In parallel, CorMedix is leveraging its taurolidine technology to develop a pipeline of

antimicrobial medical devices, with active programs in surgical sutures and meshes, and topical

hydrogels. The company is also working with top-tier researchers to develop taurolidine-based

therapies for rare pediatric cancers. For more information, visit: www.cormedix.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. All statements,

other than statements of historical facts, regarding management’s expectations, beliefs, goals,

plans or CorMedix’s prospects, future financial position, financing plans, future revenues and

projected costs should be considered forward-looking. Readers are cautioned that actual results

may differ materially from projections or estimates due to a variety of important factors,

including: the results of our discussions with the FDA regarding the Neutrolin development path,

including whether a second Phase 3 clinical trial for Neutrolin will be required; the resources

needed to complete the information required to submit a new drug application for Neutrolin to

the FDA; the risks and uncertainties associated with CorMedix’s ability to manage its limited cash

resources and the impact on current, planned or future research, including the continued

development of Neutrolin and research for additional uses for taurolidine; obtaining additional

financing to support CorMedix’s research and development and clinical activities and operations;

preclinical results are not indicative of success in clinical trials and might not be replicated in any

subsequent studies or trials; and the ability to retain and hire necessary personnel to staff our

operations appropriately. These and other risks are described in greater detail in CorMedix’s

filings with the SEC, copies of which are available free of charge at the SEC’s website at

www.sec.gov or upon request from CorMedix. CorMedix may not actually achieve the goals or

plans described in its forward-looking statements, and investors should not place undue reliance

on these statements. CorMedix assumes no obligation and does not intend to update these

forward-looking statements, except as required by law.

Investor Contact:

Dan Ferry

Managing Director

LifeSci Advisors

617-535-7746